Global Payroll Updates

Details the mass updates that can be made within a pay cycle on Step 2 of Payroll.

OVERVIEW

You can make mass updates that apply to all of your employees within a pay cycle on Step 2 of Payroll. These updates will only apply to the active pay cycle. Global Payroll Updates are helpful for processing bonuses or commissions that aren't taxed the same, or have benefits deducted or garnishments taken out.

MAKING A GLOBAL PAYROLL UPDATE

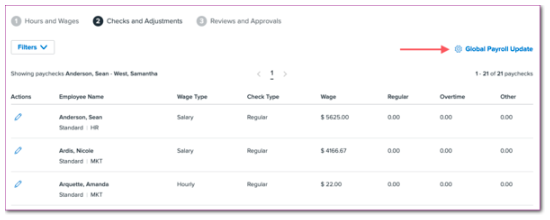

From Step 2 of Payroll, click Global Payroll Update:

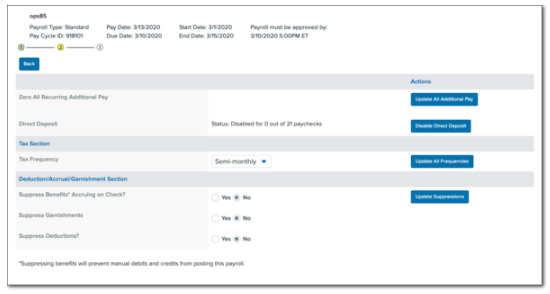

You'll be taken to the Global Payroll Update page:

You can apply the following global updates from this page:

-

Zero all recurring additional pay for all employees.

-

Click Disable Direct Deposit to disable direct deposit for all employees.

-

Stop Namely check printing to print in-house. See In-House Check Printing for more information.

-

Adjust the tax frequency and federal withholding percentage for all employees.

-

Individual changes to an employee’s federal withholding will override any adjustments made on the Global Payroll Update page.

-

-

Suppress garnishments, deductions, and benefits accrual for all employees.

-

Suppressing benefits prevents manual debits and credits from posting on this payroll.

-

After you've made any desired changes, click Back.